Your home is on fire (God forbid) and you have time to safely grab 5 items (assume all people and animals are safe). What did you grab?

This is not a post about the tragic consequence of anyone’s property actually being on fire but one of personal conflict between what’s practical, valuable and sentimental and planning for ahead. What you would take from your burning house reflects your interests, background and priorities. Think of it as an interview about your life, condensed into one question: What would you save?

Maybe you’re now pondering this question: “What would I take from my burning house?” Would you go the practical route and snatch your computer or phone, or are you more sentimental, opting for old photos and toys? It’s a tough one.

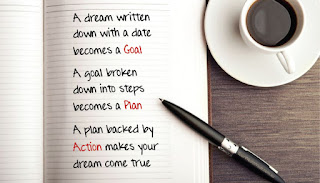

Sometimes it takes a moment of crisis to realize what matters. Sometimes it takes a really difficult question to force you to think about what you value in life. A plan is critical even if it’s formulated over the course of a minute.

So you’ve got your 5 items together but what about the rest of the contents when it does burn to the ground? Oh well that’s easy right, insurance takes care of that. Sure it does, but what exactly was in there and what was everything valued at? Here’s a quick tip that you can do next time you have a spare hours, or when there’s nothing on TV: Create a mini movie, room-by-room, the playback being very valuable when making an insurance claim. Walk through each room and record your stuff. Be sure to shoot serial numbers and add commentary by reading out model numbers. Save it onto a hard drive or flash-drive, collect important receipts and documents and store it all together in a quick-to-go place.

So now you’ve got a plan for when your house burns down. What about a plan for the inevitable: Life? Yep you need a plan to be financially secure when you grow old – and anywhere in between. You need a financial plan. Again, you need to spend a bit of time putting it together, collecting your important financial information and then starting a budget so you know what’s coming in and what’s going out, money-wise. It’s not that hard. You can start here by downloading our Free Your Money Sense e-Book: “6-steps to Financial Security”.

So back to the burning house. We’ll assume the cat and dog were ok: What 5 things did you grab?