There are a heap of ‘Manage-My-Money’ APPs and Software Platforms out there now.

They are a fantastic start for anyone that doesn’t have control over their money.

They scrape your bank accounts and show you what you are spending and categorise that spending, however without too much detail, so you roughly know what you are spending your money on.

Better to know than not to know.

These Apps aren’t really going to let you get ahead, or save, they just help you to not overspend.

Now, if you want more than just a summary of what you have and what you've spent, you need to be preparing a budget of your cash-flow – where your money comes in from and where it goes out to.

But no-one wants to create a budget. That’s way too hard, right?

Agreed. So we've built Your Spending Plan which is an easy to use budget planning tool, stepping further into managing your spending categories than the account scraping APPs, in order to save you real money, and put more in your pocket, and even get you saving for those bigger purchases or life-event needs.

Your Spending Plan is not an automated scraping tool, like the multitude of APPs out there, as the information needs to be accurate and detailed. And driven by you, not an algorithm.

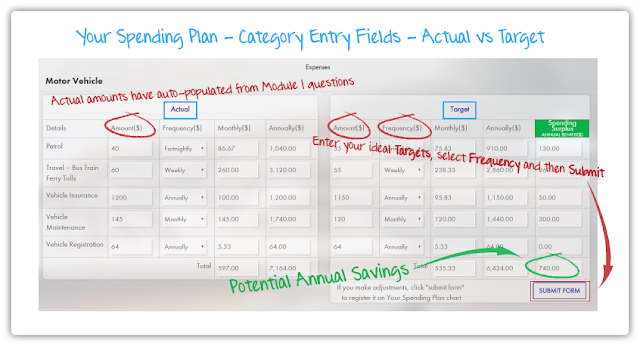

It’s a step-by-step module course showing you how to gather, categorise and act on your expenses and make real savings.

I won’t sugar-coat it, there is manual entry required to get it started so you will need to gather your bills and expenses together. One of the great things about the Your Money Sense course is that it guides you through each step so you know what to do and have plenty of time to do it.

Once your money flow is categorised you can model your expenses to see what a slight adjustment can do to affect your savings in the short, mid or long term.

Best created on a desktop, the proprietary smart dashboard shows you what your ideal target expenses should be and once you have made some realistic changes, what your expenses target looks like.

If you really want to get on top of your money – control it rather than letting it control you – then you should use Your Spending Plan. It should end up saving you considerably more than the $14.99 it costs to use each month.

___________________________________________________________________________

Don't forget to take our FREE Your Money Personality Quiz to determine what money means to you and how you react to it. It's enlightening!