The countdown to Christmas is on. Such a lead up of parties, families

and gift-giving.

And then it’s over!

New Year rolls around and a couple of things aren’t quite how you left

them.

Firstly, your waistline is a couple of inches larger, and secondly your

credit card debt is considerably larger too.

So how do you start 2018 in better shape – both physically and

financially?

Let’s start with your expanding waistline.

One of the best ways to quickly drop a couple of sizes whilst retaining

all the nutrients you need is to ‘Juice’. Yes, just put a bunch of Fruit & Vegetables

through a juicer: All the F&V that you like and a few more beneficial

varieties that you don’t normally eat. It all literally blends together with

the dominant flavour rising anyway. And generally, it all turns brown. Sounds

nice huh?

Sure, it takes some time to cut all the F&V, and even more time to

wash the juicer, but you’ve usually got enough for more than one meal.

Oh, and don’t forget to exercise. It gets your juices flowing,

literally. Your blood is pumping sending lots of oxygen to the dark recesses of

your body, and it makes you feel better, more energy, and you’ll sleep well.

The weight should drop off too.

Nothing that’s good for you is ever easy. A little effort at the start

with a lot of reward to follow.

So now what do you do about the expanding credit card statement?

Just like your expanding waistline, action needs to be taken.

With around $32 billion owing in

Australian credit card debt, that's an average of around $4,300 per credit card

holder and you are one of them caught in that circle of “buy now, worry about

paying later”.

So, you have a few options to alleviate

your debt, explained in detail in our article 3 Quick Ways to Reduce your Credit Card Debt

Ask your

credit card issuer to see if they’re willing to change the terms of your credit

card so that it tilts a little more favourably in your direction? You’d be

surprised what they can and will do to help.

Here are the 3 tips in summary:

- · Ask your credit card provider to waive late fees for a month.

- · Ask them to lower the Annual Percentage Rate (APR).

- · Change your Payment Due date.

There are a

few genuine ways that you could realistically reduce your credit card debt. If

you’re still having a problem, find another credit card provider and transfer

the balance – they’re always offering that.

Taking control of your credit cards is

just another step in the process of controlling your overall financial

situation.

Of course, the best way to avoid the

post-Christmas bill-shock is to plan, or budget, in the lead up to the

gift-giving, party-attending, family-celebrating season.

Who likes budgeting?

Who knows how to budget?

Who knows where they can

save money easily?

I know, I know, the answer is probably 3

out of 3 No’s.

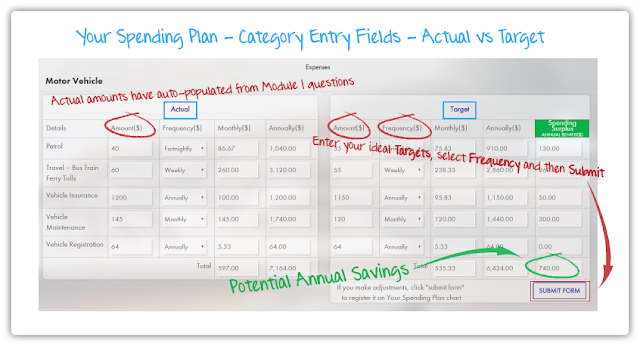

Here is a really good budgeting tool that takes you beyond

plugging in numbers and trying to figure out what it all means. You create a Spending Plan so you know what you are

spending to the cent, and where you can save money. The budgeting tool is in

the form of a course, which guides you step-by-step where to find and how to

input all of your money which flows in and flows out. That’s called cash-flow.

Your Spending Plan has a great

bill-saving calculator that can show you where you can save money by making

slight changes, and how that impacts your overall cash-flow by the week, month

or year.

Don’t suffer from credit card shock

again, get organised and set up Your Spending Plan now.

_____________________________________________________________________________

If you are interested in some Holiday

reading, here’s a great Free e-book from Your Money Sense: 6-steps to

Financial Security It’s a good starting point to get you in the right mindset

to manage your money.