When you get your pay cheque, whether that’s weekly,

fortnightly, or monthly, check the instructions.

What? You didn’t get instructions with your pay-cheque!

Instructions seem to be included with everything these days,

yet with something as important as your money, you don’t get instructions. You’re

just left to figure it out.

How much should you spend to make it through to your next

pay-cheque? How much can you save? How much do you need for groceries, bills,

kids and so on?

No one is born with money management skills, it is a learned

skill. And those that do learn it DO manage their money better. They have more

to spend, more to save, and more to go around in general.

If you can build a personal, family or household budget, you’ll

manage your money effectively and have more money in your pocket.

Often people don’t

attempt to make a budget because they don’t want to face the realisation of frustration,

guilt, envy, anger, shame or disappointment.

If this sounds like you, Get Over It!

It’s never too late to start managing your money. Create a

budget, or Spending Plan, now and the benefits will show immediately.

If you budget well, you don’t have to make more money, but

you will have more money available.

I’m about you to give you the 7 Steps you need to get on top before you build Your Spending Plan,

but don’t be put off as there is an easy to way to implement all of this. You’ll

get a link to a shortcut and easy way to create Your Spending Plan at the end of this article.

- Setting Goals – What do you want and when do you want it?

Make realistic goals to work toward.

- Identifying Income and Expenses – Put your hands on your

bills and expenses. “Garbage In = Garbage Out”. Get it right the first time.

- Separating Needs From Wants: You have to prioritise what

your money will be spent on. You can’t have everything.

- Designing Your Budget: You must work out what current and

future spending is required. This needs planning.

- Putting your Spending Plan into Action: You need to check

and make regular updates for Your Spending Plan to work. It is not a once off exercise.

- Managing seasonal expenses: Your expenses are not always the

same. You need the tools to make this as easy as possible.

- Look ahead: How will your personal circumstances change in

the future? What could happen in a year, 5 years, 10 years?

If you put a Spending Plan in place, you’ll always live

within your means. You’ll know at a glance what expenses are coming up, what

you’ve been spending, and how much you have to splurge on life’s little

luxuries.

You’ll avoid the anxiety of not knowing what’s next.

Money can be a great

thing to have but a dangerous thing if you don’t know how to manage it.

Your money should give you a sense of happiness and freedom,

not fear, anxiety and uncertainty.

The basis of happy money is knowledge, and it’s not that

hard to get. Your Spending Plan is designed to make you get the most from the money

you have.

I’m gathering if you don’t already have a household or

personal budget, it’s because you don’t know where to start.

Online spreadsheets and budget are a challenge, for anyone.

Where do you start, what does that mean, what does this mean? What goes here,

what goes there.

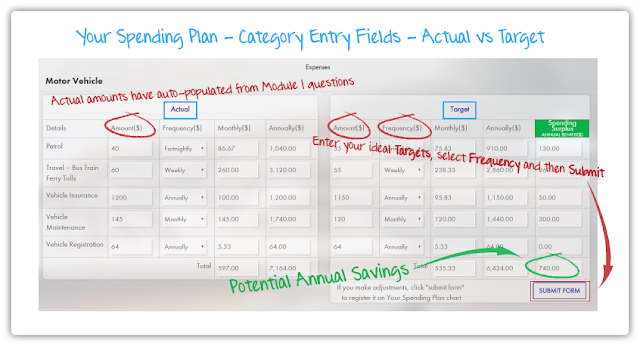

So here is the link to the shortcut I told you about. Your Spending

Plan as built by a Sydney based company, Your Wealth Vault, educates

people through the process of setting up a personal budget.

They have built an easy to use course which guides you

through the 7 Steps to making a budget, and half way through you’ll have your

fully functioning Spending Plan, just by way of following through the quick and

easy course.

You’re probably thinking that all sounds too easy, there

must be a catch.

There is no “catch”, but there is a charge to use this

ground-breaking money-saving software. Good thing is, it’s no more than the

cost of few cups of coffee a month, or a bottle of wine, and way less than a

few hours parking at a Sydney beach.

If you are serious about getting your finances organised,

and making your money “happy”, then start the Course and create Your Spending Plan.

You can always easily cancel if you feel it’s all too hard and life can “just

go on”.