I’m sure you are all aware of the number one way to reduce credit card debt: Pay it in full whenever you get your statement. And the second piece of common advice about managing credit card debt: Don’t use it. Easier said than done sometimes.

Even the most organised amongst us may feel like we’re spinning our wheels sometimes when it comes to credit card debt, and the situation isn’t helped by the fees and interest rates often charged by credit card companies

With around $32 billion owing in Australia, that’s an average of around $4,300 per card holder. The level of credit card debt can go up or down depending on what the trend is on a monthly basis but the average card holder is paying around $700 in interest per year if their interest rate is between 15 to 20%. And as we know most of the card interest rates are more than that.

Somehow, it feels a lot easier to get into debt than dig yourself out of it. But here’s the thing—have you actually asked your credit card issuer to see if they’re willing to change the terms of your credit card so that it tilts a little more favourably in your direction?

Odds are, if you’re like a lot of people, you haven’t even tried. We constantly receive offers for new credit cards by mail and email, and the more in debt you are the more offers you will get. Banks are falling all over each other to get new customers and keep the ones they have. So if you have an outstanding balance, maybe you should try negotiating more favourable terms for paying it off. Yep, really.

So here are 3 Top Tips for getting your credit card balance paid off quicker.

One: Will You Waive My Late Fee?

Sometimes we just forget to do things. With all the best intentions in the world and even a diarized note, you still forget. When you forget your due by date on your credit card payment there is no forgiveness, you get slogged bad.

But card issuers may actually be more merciful than you think. A growing number of banks will waive the first late fee if you ask.

Having a pristine record of paying on time and a legitimate excuse for dropping the ball (for example, an illness or family emergency) may also increase your chances of getting the fee forgiven. Just don’t make a habit of calling and asking for forgiveness, you will be on record and your credibility and the bank’s kind attitude could dry up fast.

Two: Can You Lower My APR?

Ask for a lower annual percentage rate (APR), but do your homework first. Keep a file of all the offers that come through the mail box, and an email folder of the offers that come through digitally from other credit card providers. When it’s time to ask for a lower rate, have your facts and figures of current comparisons on hand and use them as a baseline for your conversation. “XYZ credit card offered XX% and my rate is X+Y%. Can you match that?” Be nice and polite, but be direct and assertive as to what you want.

Typically a bank may offer to knock off 2 or 3 percentage points, but it’s okay to ask for a little more than that. You have every right to make these requests, just as long as you are nice and polite.

If you carry $5,000 of credit card debt at 18% interest that you pay down at the rate of $100 a month, it’ll take you almost eight years to pay off that card. But if your interest rate is 15%, it’ll take you about six and a half years. While you’re at it you might want to work out how much you’d have to pay each month to pay off your balance in five years… or less! It’ll be worth it in the long run.

Three: Can I Change My Payment Due Date?

If you find you’re more likely to pay your balance off in full at a certain time of the month rather than when the credit card company expects you to, consider asking your provider to change your due date to a day that’s more convenient for you. That’s not an unreasonable request.

Everyone has different ebbs and flows with their money and when different bills and payments are due. The date you get paid influences when you have money available for payments. If you get paid once a month on the first of the month, it’s probably a lot easier to have your payment due earlier in the month rather than later, after you’ve spent your money on other things. A lot of times a bank might work with you to change your payment due date; it’s all about making payments on time every time.

Just be aware that if you carry a balance and you’re pushing your due date out, from the 1st to the 15th, you’ll be paying finance charges on those extra days that your balance would be accruing interest during your first changed billing cycle.

So you can see there are a few genuine ways that you could realistically reduce your credit card debt. If you’re still having a problem, find another credit card provider and transfer the balance – they’re always offering that.

Taking control of your credit cards is just another step in the process of controlling your overall financial situation.

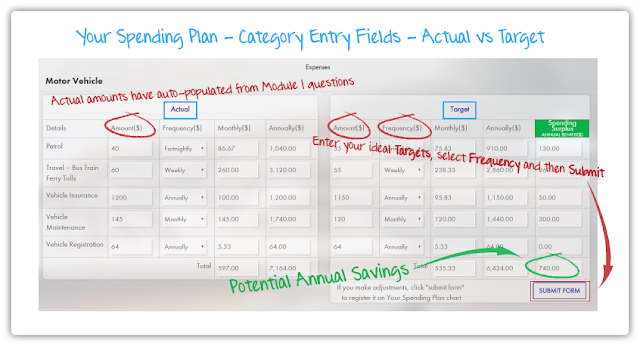

Your Money Sense is an online financial education program where you’ll learn how to take control of your money, step-by-step, identifying where you can save and where you can spend without blowing the budget.

Our proprietary budgeting tool guides you on how to budget, and you’ll easily learn everything you need to know to manage your money to make confident decisions.